Tips & Tools

Your Money is Safest in the Bank

The Russian invasion of Ukraine is causing many concerns. One thing you can count on is the safety of your money in the bank.

Due to the unrest in Europe, we continue to be in a heightened threat environment. As your trusted Community Bank, it is our goal to educate our customers as information becomes available.

- You have continued access to your funds & bank services. You have access to your funds through in-person services & electronic tools, such as mobile & online banking.

- Your money is safe, secure, & insured. The Federal Deposit Insurance Corporation (FDIC) insures individual bank deposits for up to $250,000. No consumer has lost a single penny in the history of this insurance fund. You don't have the same level of protection when your money is outside the banking system.

- KodaBank is prepared. Banks prepare for & respond to recessions, natural disasters, & other business disruptions with tested & proven business continuity plans & procedures. Banks have the highest level of security among critical U.S. industries - including energy & telecommunications - and the most stringent regulatory requirements.

- You can help safeguard your money. Check your account often & notify the bank immediately if you suspect fraud.

- Your banker is listening & ready to act. Reach out to your banker with any concerns. North Dakota's banking industry is strong & ready to help.

How Money Smart Are You?

Learn about everyday financial topics.

How Smart Are You? is a suite of 14 games & related resources about everyday financial topics. It's based on FDIC's award winning Money Smart program.

- Borrowing Basics

- Building Your Financial Future

- Buying a Home

- Credit Reports & Scores

- Disasters - Financial Preparation & Recovery

- Making Housing Decisions

- Managing Debt

- Protecting Your Identity & Other Assets

- Using Credit Cards

- You Can Bank On It

- Your Income & Expenses

- Your Money Values & Influences

- Your Savings

- Your Spending & Savings Plan

Romance Scams are on the Rise

Is it amour - or scam-more?

Online romance may begin with Panic! At the Dicso's High Hopes, but according to a new FTC Data Spotlight, all too often it ends with the conclusion that - to quote the J. Geils Band - Love Stinks.

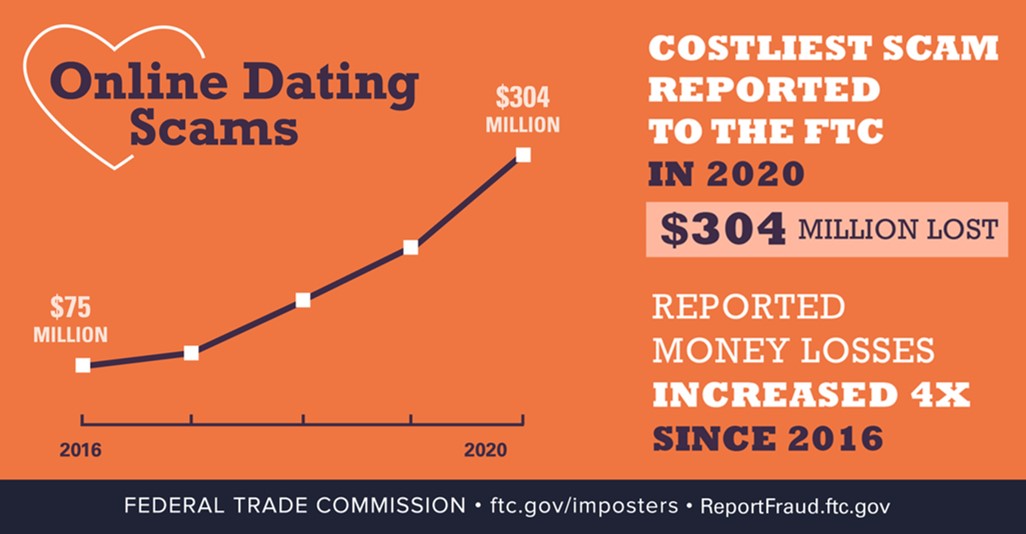

Far be it from us to put a damper on Valentine's Day, but reports to the Consumer Sentinel Network suggest that the injury inflicted by romance scams is on the rise. According to the new Data Spotlight, "For three years running, people have reported losing more money on romance scams than on any other fraud type identified in Sentinel. In 2020, reported losses to romance scams reached a record $304 million, up about 50% from 2019. For an individual, that meant a median dollar loss of $2,500."

Why the increase? The continued popularity of dating apps is part of the story, but the pandemic has played a part, too. For right now, the need for social distancing and masking makes the "meet cute" at the local coffee shop less likely. Of course, we've all heard heart-warming stories of romances that started on screen and blossomed IRL, but the Data Spotlight suggest that at least some of those digital dalliances may be hiding something more sinister.

What does that have to do with you? We thought you'd never ask. Chances are that someone you know - a friend or family member perhaps - has a long-distance love they have yet to meet. A subtle word from you about the telltale signs of a romance scam could mean one less report to Consumer Sentinel in 2021 about a heart broken and a wallet emptied by a romance scammer.

It can be a difficult topic to broach, but we have a sure-fire opener: "I just read the most fascinating thing on the website of the Federal Trade Commission, America's consumer protection agency." (What? That's not your typical conversation starter? No Valentine for you!)

Regardless of how you bring up the topic, Valentine's Day offers a way to share some heart-to-heart hints.

Romance scams can happen to anyone. According to the Data Spotlight, reports of money lost on romance scams increased for every age group in 2020. The 20-29 crowd saw the most notable spike, with the number of reports more than doubling since 2019. People between 40 and 69 were once again the most likely to report losing money to romance scams. And people 70+ reported the highest individual median losses at $9,475.

Every picture tells a story, but some of those stories are fiction. Knowing that fetching photos can lure in a love, scammers routinely steal people's snaps and pass themselves off as the person in the picture. To investigate their identity, try a reverse-image search of their profile picture or other photos they send you. If the pictures is associated with another name or if they details don't match up, you're dealing with a scammer.

Don't mix romance with finance. We've always cautioned people not to wire money or send gift cards to online loves, but we have a new tip to add. Don't let your guard down just because that special someone sends you money first. You can bet the money's stolen. Next, they'll want you to send it on for some cooked-up reason. This is how people become unwitting accomplices to money laundering. As soon as the requests for money start, it's time to - depending on your musical generation - Go Your Own Way, bid them Bye Bye Bye, or make it clear that We Are Never Ever Getting Back Together.

The Federal Trade Commission Business Blog - February 11, 2011

What You Need to Know About Romance Scams

- working on an oil rig

- in the military

- a doctor with an international organization

- pay for a plane ticket or other travel expenses

- pay for surgery or other medical expenses

- pay customs fees to retrieve something

- pay off gambling debts

- pay for a visa or other official travel documents

- by wiring money

- with reload cards like MoneyPak or gift cards from vendors like Amazon, Google Play, iTunes, or Steam